New Opportunities

Historically, agricultural investments like cattle have only been accessible to investors with significant capital, vast industry expertise, and direct connections to producers. FarmAfield has removed those barriers by:

Different Assets, Different Results

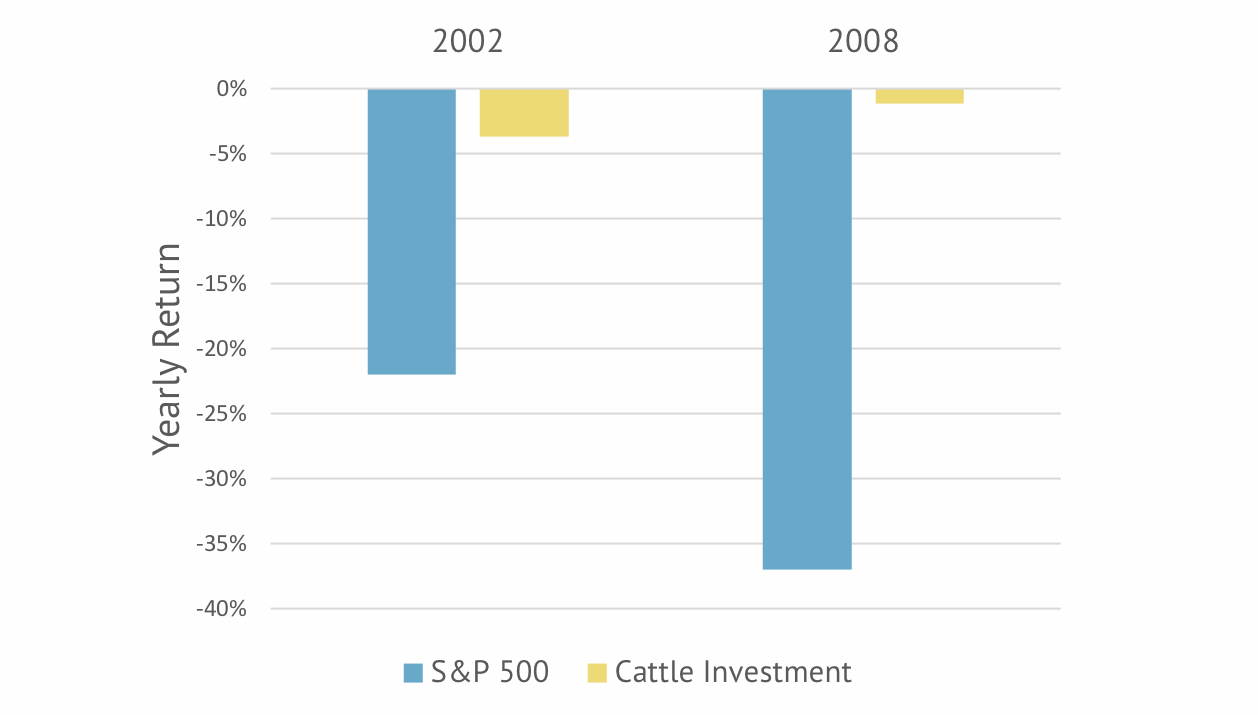

When you invest through FarmAfield, you're buying real agricultural assets — commodities that are non-correlated with the stock market info . Why is this important? A diversified portfolio is the cornerstone of any risk management strategy. If an entire portfolio consists of similar assets, a singular market downturn can erase gains made over many years. Non-correlated assets like cattle provide an excellent safety net info during these stock market downturns, helping you to maximize your overall returns.

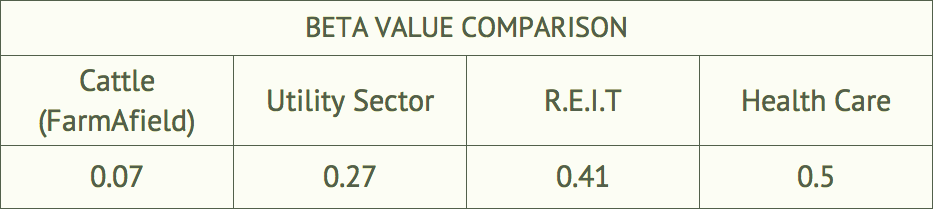

Correlation is expressed using a beta value. A beta value of 1.0 between two asset classes indicates that they move in lockstep. A beta of -1.0 indicates they move in opposite directions, and a beta of 0 indicates there is no correlation in their price movement.

Over the past 20 years, the beta value of a hypothetical cattle investment (similar to the ones possible through FarmAfield) in comparison to the S&P 500 is .07 which is quite low compared to other alternative asset classes.

Pulling from major market downturns in past 20 years, we compared the performance of a cattle investment with the S & P 500.

Competitive Returns

Since our first offering in March of 2016, FarmAfield's investments in partner farms have yielded an average raw return of 5.2% and 9.9% annualized.

Learn more about the assumptions in this section.

0.65% represents the five-year trailing APY on the Vanguard Total Bond Market Index Fund (VBMFX).

5.0% represents the current APY for a 9-month high yield CD from Marcus by Goldman Sachs.

5.2% represents the non-annualized average returns on investments in 129 FarmAfield partner cattle lots since March of 2016. The average annualized return is 9.9% with an average cycle time of 203 calendar days.

Data last updated: Sep., 2023

How It Works

Fund Your Account

Get set up to purchase agricultural assets by transferring funds into your FarmAfield account.

Purchase Your Assets

Once there are funds in your account, we'll start sending you purchase opportunities for new assets like cattle or solar projects as they become available.

Watch Them Grow

Monitor your virtual farm on FarmAfield’s online dashboard and receive reports on your assets' value and performance.

Receive Your Returns

When your assets reach maturity and are sold, the proceeds are deposited in your FarmAfield account where they can be withdrawn, held, or reinvested in new opportunities.

Investment Opportunities

Cattle Lot 25071

IN PROGRESS

| Breed | |

| Sex | |

| Avg. Weight | lbs. |

| Time to Market | ~ 1 month |

Cattle Lot 25091

IN PROGRESS

| Breed | |

| Sex | |

| Avg. Weight | lbs. |

| Time to Market | ~ 1 month |

Upcoming Projects

Equipment Management